Must read book to learn about startups, business development, and dynamics of markets. ⭐⭐⭐⭐⭐

Introduction

- The book deep dives into failures of company. Not bad companies but good companies. The companies were admired by everyone and was known for excellent management

- These companies are generally of fast moving industries

- These companies failed when confronted with disruptive technology

- The way the decisions are made in successfully managed companies leads to its eventual demise – hypothesis of the book

- Sometimes, doing right things in business like listening to customer, making things that people wants, etc doesn’t lead to best results.

- Sustaining technologies: technologies which are incremental in nature. Can be discontinuous or radical in nature. Never leads to failure of industries

- Disruptive technology: result in bad product experience, in near term. But are generally adopted by niche / new customers for their small set of unique features like cost, simpler, smaller, convenience

- Market Need vs Technology Improvement: second reason for failure framework is “technology can progress faster than market demand”. For example: people who required mainframe, can do all their tasks now in a personal computer. Or, the need of mainframe users increased slowly than rate of improvement in computer

- Rational investments: companies investing in disruptive technology is not a good approach. Because of low margins, niche users.

Principles of Disruptive Innovation:

- Companies depend on customers or investors for resources: sustaining companies kill the ideas that their customers don’t want. Hence no resources for low margins opportunities that their customers don’t want. Until they want it. The only way to avoid this is to create separate company inside the company, free from burden of existing customers with mandated fixed resource

This is why corporate development exists. For companies to buy things out of their domain

- Small market don’t solve the growth need of large companies: because the markets are small for large companies to look into. Another strategy used by companies is to wait until the market becomes big. This doesn’t work. A good way to handle this is to partner with organization whose size matches with target market, as they understand the customers better and can help you commercialise this better

- Market that doesn’t exists, can’t be analysed: since not data exists on new markets, companies that plan their investment either becomes paralyzed or makes mistakes in assessing the estimate. To solve this, one should follow discovery based forecast where assume everything you know might be wrong. It helps you to cope better with disruptive technology

- An organisation’s capabilities defines it’s disabilities: organisations have capabilities that exists independently of the people who work with them. Organization capabilities = processes (how to get things done) + values (what company cares about). The very processes and values that helps excel companies in one domain, causes failure on another

- Technology Supply ≠ Market demand: when companies overshoot customer’s demand by creating product of high performance and high price, the create a vacuum at lower price points. This vacuum is filled by disruptive technology.

Chapter 1

- Firms succeed when they listen to customer and invest aggressively in technology, products and manufacturing that satisfy their customers need. They fail for the same reason. This is innovator’s dilemma.

- Wisdom is knowing when listening to customers makes sense.

- Sustaining technologies i.e companies giving their customers what they want, the leading companies rarely fails.

- Disruptive technologies create new companies. For example, 14 in disks were popularly used in mainframe computer, has better performance than 8 in disks in every terms except size. 8 in disk found market in mini computer which was different than mainframes. Soon sustaining improvements in 8 in disks surpassed 14 in in all terms and thus started invading mainframe computers

- Most of the 14 in manufacturer went out of business. The few who sustained built 8 in disks at par at with new companies

- In interview with 14 in manufacturer, they said that they were kept captive by their customer as customers specifically said they want 14 in disk with more memory and lower cost

- The same thing happened after with 8 in as well with 5.25 in and then with 3.5 in, and then with 2.5 in

- “The fear of cannibalizing sales of existing products is often cited as a reason why established firms delay the introduction of new technologies “

- People don’t want to change. Inertia makes all of these happen. Established firms fail to create new products because they focus on their customer too much and their customer doesn’t want to change as such. This creates new markets for entrants which are untouched by established companies. Once these markets becomes big for established companies, the majority of customer don’t want to change with entrant companies.

This is where VC money comes in, because here you can capture as much market as you want before competition comes in. One can use VC money to scale rapidly to customers. VC money for disruptive technology rather than sustaining technology

- Interestingly customers of 3.5 in disks wanted 2.5 in disk to ship in laptops and the established firms in 3.5 in listened to their customers to build 2.5 in disk. This was sustaining tech

Summary

- Disruptive tech was technically simple and packaged existing things in new way and created new market

- Sustaining tech always focuses on established trajectory of improved performance, higher margins and lower costs. The customer led them towards sustaining technologies

- Entrants always creates new markets and lead in disruptive technologies

- Established firms even thought aggressive, innovative and customer centric in their approach built sustaining improvements but unable to accept downward vision and in new market, and in trajectory

Chapter 2

- Conway’s law, the organization’s structure and how it’s team communicates cab be observed in how their top products are built.

- If you invert this, the structure of the company and affect the way it can and cannot build new products.

- Thought: companies are living things. It evolves as the companies grows, and comes into a stable local optimum in terms of skills, team structures, component distribution. It is not always optimal if this structure and split of teams is suitable to build a new product / disruptive tech

- Additionally, established firms has talent related to what they have been doing. While entrant firms are better at exploring new tech.

- Firms fails when the technological change destroys value competencies / moat previously built and succeeds when new technologies enhances them

- Value Networks: the way the company works, it’s structures, skills, management, past decision and experience. How it gets things done. What part it commercializes? what parts you procure and what parts you build? For example a like apple, can also sell individual components of iMac and phones to other companies, but doesn’t.

- Value Networks mirrors product architecture

- Disruptive innovation starts in a different application market, thus is hard to predict by sustaining companies

- Scarce allocation to new projects / disruptive innovation by management and more resource to sustaining projects as their immediate need from customers, leads to failure of existing firms. Less short term thinking, more long term thinking

- How it generally happens with disruptive tech

- Disruptive tech were developed within established firms

- Marketing personnel tried selling this to existing customer. Also since tech is not yet optimised, the performance is worst compared to sustaining in some parameters (like disk storage)

- Established firms step up the pace of sustaining tech development, as they think disruptivr tech is not the way to go forward

- New companies are formed and markets for disruptive tech is found by trial and error. Generally by ex-employees from established firms

- Established firms belatedly jumps in the market to defend customer base. By then it’s too late

- Applying these concepts to flash drive industries

- Capabilities Viewpoint: Disk drive companies which had skills in integrated circuit were able to survive during flask drive disruption. If customers are demanding capabilities, firm may develop and acquire the skills from outside.

- Organizational Viewpoint: since flask drives architecture is radically different, established firms should create an organizationally independent groups to build this and succeed in this

- Technology S Curve: if the curve has passed it’s point of inflection (that it is improving at decreasing rate), there is an possibility of emerging of new tech. With magnetic disks upto 1995, the capabilities were growing at great speed, thus flash memory was not a threat

- S curves are only useful for sustaining technology. Disruptive tech creates parallel s curves which intersect later with sustaining s curve

Final takeaways:

- Value Networks are defined by a rank ordering of importance of various performance attributes. Also includes cost structures

- It’s all about customers. Established firms can easily commercialize products in their value network. These innovations are generally sustaining. They fail to innovate in new value networks. These are disruptive in nature

- Entrant firms have attackers advantage, because new products provide no value to established firms in their established value network.

- The way to avoid this for established firms is to improve it’s relative flexibility to commercialize and build. Strategies and cost structures needs to change. Not technologies

Chapter 3

- The concepts discussed above can also be seen in excavation industry.

- This industry was dominated by use of cable and diesel engines. The existing tech was used mainly for digging at construction sites, for sewage pipelines and for during mining.

- Important features for existing customers are single scoop volume which ranged from yard to 5 cu yard.

- Initial launch of hydraulic based machines had volume of .25 cu yard thus were unusable for existing customers. Thus they found market in another domain like agriculture and slowly moved towards sewage digging and then general excavation

- Some companies tried to merge both tech to create hybrid systems based on hydraulic and cable. This allowed them to market the new tech to existing customers as sustaining improvement. They didn’t create a new value market for disruptive tech. This option is always available to deal with disruptive innovation

- Established firms attempt to push the new technology to existing customers while entrant companies fine a new market that values them.

- Once both cable and hydraulic machines provided similar capabilities in attributes mattered to general excavation users, people start looking at other attributes like safety on which hydraulic was better.

- Hydraulic machines started in another market like agriculture and slowly started eating the market share of sewage digging and general excavation. The established firms tried to sell this early to their customer and failed, instead they should have focused on creating new value networks and slowly moved towards selling to existing customers when capabilities are at par.

Chapter 4

- Companies have choice of making two types of mobility: upward mobility (moving into the market of higher gross margin and bigger market size) and downward mobility (where market is small and uncertain)

- Even companies with good manager move towards “north east” or upward. As it makes sense for them and can justify allocating resources to projects

- Even the firm which commercialized disruptive projects in disk drive, choose not to remain in their initial value network. They moved tried reaching upward, with each new product.

- Value network and cost structures drive this movement

- One companies have decent share in their initial value network, the start to optimize for various things in companies. This short term optimization, leads to upward mobility

- Companies leave they disruptive root in search for greater profitability in market tiers above them. These companies come to acquire the cost structures required to compete in those upper market tiers

Resource Allocation

- In a completely top down approach or rational, the senior managers find or create projects aligned with firms strategy and focus on projects that provides better returns on investment (greedy approach)

- Joseph Bower

- most innovative projects arise deep from the organization’s (ICs)

- These projects bubble up from ICs to top management, thus middle managers play a crucial role in highlighting and screening these projects

- Middle managers need to decide which projects to choose given corporate finance, competitive, strategic climate

Role of Middle Managers

- Middle managers grow when the can lead successful projects and their career can be permanently derailed if they pick bad projects that fail

- They won’t be penalized for all failures. For example projects where tech is unable to deliver are not managers failure.

- These cases are not even considered as failures because tech dev is unpredictable and probabilistic endeavor. Even in failure it teaches s lot

- Projects that fail because market wasn’t there have much serious implications on managers career. As lot more investment is done in latter case. Investment in terms of design, manufacturing, engineering, marketing, distribution, etc

Software thus are different cases: even if there is no market, the only cost is engineering. Thus, much more experimentation can be done here

- Because of this managers tend to choose projects which has high probability of success

- Companies should a systematic structure for exploratory projects, if not they can fail

- Most innovative projects doesn’t come from top management but from individual contributors at the bottom level. Company need to build a culture of innovation otherwise it is very difficult for managers to motivate competent people to work on projects which makes no sense, and might not reward them

Three things which create obstacles for companies in moving downwards

- Higher margins

- Customer moving in the same directions in B2B

- Higher cost structures of big companies

A similar case was observed in steel manufacturing. Minimills can generate steel from scrap parts but cannot provide finish like integrated steels companies which create steel from ore. Minimills requires less capital, and I’d cheaper to produce, this was able to capture low margin market like rods,etc from integrate steels. But soon with thin slab casting method which was disruptive in nature, they could invade north east market of integrated steels

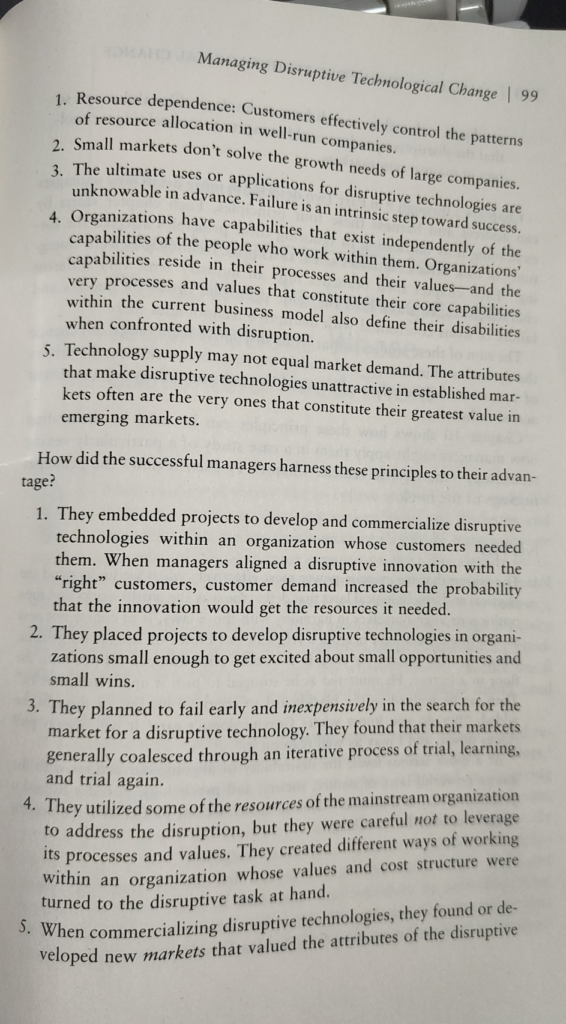

Part II: Managing Disruptive Technological Change

“good management” was root cause of why companies failed when encountered disruptive technology

Good management:

- Listening carefully to customers

- Tracking competitors actions

- Investing in design and manufacturing of higher performance and higher margins products. Focusing on large market

Page 99, Principles of Disruptive Tech

Chapter 5

Resource dependence theory:

- Organizations survive with resources provided to them. Primarily by customers or investors

- Company’s customers controls what it can and cannot do

- Managers thus are powerless to change the course of their team against the will of their customers

What should managers do when faced with disruptive tech?

- Option 1: convince all the leadership, that things you are building has a long term strategic importance, despite rejection from customers

- Option 2: create a small independent organization and embed it with customers that do need the tech

- Options 2 works well. Option 1 rarely works as managers here are picking fight with organization’s nature to listen to customers

Why managers fail to realise disruptive tech?

- Managers propose projects which can accelerate their growth. These projects are generally focused on short term profits which is valued by higher management. Thus sustaining projects get more funding compared to disruptive ones

- To break out of the loop, one can create a small independent organization to commercialize the disruptive technology

- Despite developing disruptive tech, attaching the product to existing value network could be disastrous like seagate and bucyrus. Because customers will not purchase it until they want it. Thus it is important to look for new value network to initially sell an disruptive tech

Chapter 6: Match the size of the organization to the size of the market

- When dealing with disruptive tech, size of organization should match with size of the market they are dealing with

- Small markets cannot solve the need of large companies as they need a large increase in revenue to grow at decent rate. This increase in revenue is not possible at initial phase of disruptive tech

- Leadership and first movers advantage in sustaining tech is not very important. As seen in thin head tech in disk drive, all of the companies built thin head tech and few companies that built it later built it better and commercialized it better

- In disruptive technology, both first movers advantage and strong leadership is important

- Large companies stocks are generally traded in markets which require them to maintain a decent growth. Companies goto markets because it provide them with liquidity and ability to raise capital at favorable terms

- How can managers deal with disruptive tech

- Accelerate the growth of emerging market, so that it becomes big, to make big impact in large company

- Wait until market is mature and big enough, and then enter

- Give responsibility to a small organization tasked to commercialize in small markets

- First two rarely work, third work most of the times

Chapter 7: Discovering New and Emerging Markets

- Market that don’t exists cannot be analysed

- Forecasting, planning and customer analysis works for sustaining tech but not nt for disruptive tech. Because in these cases neither customer not manufacturers know what to build, what customers want and what is helpful to them. Iteration is required and process is a bit random

- Example of hp kittyhawk drive can be taken. Excessive planning and strict market was focused while building kittyhawk. They were targeting PDAs and priced it higher with additional feature. Customer like video game developers requested for these but at lower price points and less feature. They could not deliver it because of pre-planned manufacturing

- Planning for the disruptive markets rarely works. Most commonly, experts forecasts will always be wrong. As disruptive technologies, are unpredictable, companies initial strategy for entering these markets will generally be wrong

- Managers who don’t believe are fighting the principal that “creating new markets is a genuinely risky business”

- Failed ideas vs failed businesses. This means business only fails when the exhaust their resources. Otherwise they can always iteration or pivot to right thing

- Majority of companies pivot from their initial ideas

- For sustaining tech, careful planning before action and agressive execution should be done. Efforts towards meeting the targets should be made

- For disruptive tech, action should be taken before planning. Action towards learning things, interacting and not going all in initially

- Discovery driven planning: works well, which requires managers to identify assumptions upon which their business plan or aspirations are based

- Agnostic marketing: marketing under assumptions that no one, not us, not our customers know what is the best application

Chapter 8: How to Appraise Your Organisation’s Capabilities and Disabilities

- Organization, independent of the people and resources have fixed capabilities i.e. people which designed product X in a organization may not be able to design a similar product Y. Why? Explained below

Organizational capabilities framework:

What an organization can and cannot do depends on three things

- Resources: this is people, equipment, tech, design, distributors, customers. Can be bought or sold, depreciated or enhanced.

- Processes: companies through processes transforms inputs of resources into products and services of higher worth. Processed are define or evolved to address specific repetitive tasks. Processed in organizations are hard to change

- Values: values of the companies are how decisions at every level is made. These values should be passed down from top of the organization to the bottom, to keep everyone aligned on the strategic direction. The values of companies generally evolve in two directions: acceptable gross margin and market size of things to be interesting

- Huge size constitutes a very real disability in managing innovation

- With RPV framework, one can see what companies can and cannot do. For example, disk drive companies had seen 111 sustaining tech and 5 disruptive tech. Their processes embedded steps on dealing with sustaining tech and thus failed to deal with disruptive tech. Furthermore, disruptive tech showed lower margins which was against the value of the company to pursue.

Migration of Capabilities

- During startup phase, resources drive the progress. The addition of key people can derail the company.

- Over time, the success depends on processed and values. As market becomes clear, the organization need specific process and values to keep improving in that market.

- Many hot young companies flame out after they go public. This is because their success was grounded in resources, they fail to create processes that can create a sequence of hot products

- Creating capabilities through acquisition: always know why your are acquiring a company. If you want their resources, you can merge the company into parent company. If you are acquiring it due to their processes and values, then keep it as seperate company because once you merge it into parent company, those values and processed will vaporise. In such cases, parent company should infuse resources and keep the other company as seperate entity.

- Processes are hard to change because: They worked in past, thus managers thought they will work in future as well. b. processes are built to perform same repetitive task

- When to create a spin out organization depends on multiple factor like how disruptive this the innovation from the existing company, how different is it from existing values and processes. Then decision should be made whether to create a spin out or not. With heavyweight or lightweight team

- Heavyweight team is build from people pulled out from different functional organization and placed in a structure that allows them interact over issues at different pace that parent org, primarily to create new processes. Conversely, lightweight teams are tool to explore existing processes

Chapter 9: Performance Provided, Market Demand, and the Product Life Cycle

- Sustaining improvement can create a oversupply in certain dimensions of the product

- When this performance oversupply occurs, it creates opportunity for disruptive tech to emerge and invade established markets from below.

- For example, when all disk drives were providing same capacity, users choose smaller disks over larger disks.

- The products becomes commodity when more than one products are available for important attributes which users care about. This often happens due to oversupply of attributes which no one cares about.

- The order of attributes which customers generally care about is functionality, reliability, convenience and price. Every time the transition happens due to oversupply in certain attribute.

Weakness of disruptive tech are their strengths:

- the attributes which makes disruptive tech failures in mainstream market are their strengths in another market. where user’s doesn’t care about those attributes. disruptive technology faces marketing challenges rather than developmental challenge, i.e. finding right market is important than building complete, perfect product in first pass

Disruptive tech are typically simple cheaper and more reliable / convenient than established technologies

- when disruptive tech invade mainstream market, it succeeds due to it’s other attributes like simpler, cheaper and reliability

Lilly’s created insulin from non animal which reduced ppm (parts per million of impurities) from 10 to zero. They asked for 25% premium over animal insulin, did not work. But Novo’s new method to inject insulin (pen insulin) was able to get 30% premium over normal insulin.

Product whose performance exceeds market demands suffers commodity like pricing, while disruptive products that redefine the basis of competition commands a premium

Strategies on managing competition in products:

- Push upmarket towards higher end customers: useful in cases where users care about performance and reliability

- Stay with customers: build products for existing customers, keeping margins and functionalities in check

- Change the market’s demand for functionality: when price is less of concern. You can try building new features which can use excess supply in attributes

Chapter 10: Recap ✅